iPhones on EMI: Can Banks and NBFCs Lock Your Phone If You Default on Payments?

Synopsis: Buying an iPhone or other devices on EMI may soon come with a twist, miss payments, and your phone could be remotely locked. As India’s credit use surges, a small RBI rule change could reshape how millions buy gadgets on installments and think about borrowing. Imagine buying your dream iPhone, only to wake up one […] The post iPhones on EMI: Can Banks and NBFCs Lock Your Phone If You Default on Payments? appeared first on Trade Brains.

Synopsis: Buying an iPhone or other devices on EMI may soon come with a twist, miss payments, and your phone could be remotely locked. As India’s credit use surges, a small RBI rule change could reshape how millions buy gadgets on installments and think about borrowing.

Imagine buying your dream iPhone, only to wake up one morning and find it completely locked. You can’t make calls, send messages, or even use your favorite apps. The phone has turned into an expensive paperweight. Sounds scary, right? This could soon be a reality for people who buy phones on EMI and miss their monthly payments.

The Reserve Bank of India, which oversees all banks in our country, is considering a rule that would let companies remotely lock phones if buyers do not pay their monthly installments on time. This decision could change how millions of Indians buy their smartphones, especially expensive ones like iPhones.

How can it affect your purchases?

Imagine you want the latest iPhone. It’s shiny, cool, and many friends have it. But it costs a lot, sometimes as much as a month’s salary. Many people in India still want these phones, finding ways to buy them without paying all the cash up front. They use something called an EMI, which allows them to pay in smaller amounts over time.

Recently, there’s been a lot of talk about a small rule change that could make buying phones like iPhones on EMI very different in the future. This change is tiny, but it could impact millions of young people, families, and anyone who has ever used credit to buy something costly. To understand why, we first need to look at how people are using credit in India today.

A Growing Culture of Credit and Loans

In India today, many people use loans and credit cards more than ever before. This means people borrow money now and pay it back later. One sign of this is that credit card debt in India has reached nearly Rs 2.91 lakh crore, more than double the Rs 1.32 lakh crore in July 2021. In other words, in just four years, credit-card debt has grown 2.2 times.

Adding to it, the number of card issuances also grew significantly over the pats few years. According to RBI’s Database on the Indian Economy, the total number of credit card issuances rose to 11.16 crore in July 2025, up from 6.34 crore in July 2021, which is a staggering jump of 76 percent. And, not only are more Indians using cards, but they are also borrowing more per card. Average dues per card have jumped from around Rs 20,900 in mid-2021 to about Rs 26,100 in July this year, which is also a sharp 25 percent increase. And one of the reasons behind this huge pile-up is the EMI.

Also, unsecured retail loans stood at Rs 15.08 lakh crore on March 31, out of which Rs 2.95 lakh crore were credit card dues, and Rs 10.30 lakh crore were personal loans. A sharp rise was seen in credit card delinquencies (negligence) of the 91-360 day overdue category, up by more than 44 per cent in a year. They were at Rs 33,886 crore in March 2025, which was Rs 23,476 crore in the previous year.

According to the RBI’s Financial Stability Report released in June, there is a growing distress in unsecured loans. Credit card defaults are on the rise, with the gross NPA (non-performing assets) ratio going up from 1.84 per cent in March 2024 to 2.30 per cent in March 2025. Even personal loans have witnessed a marginal increase in bad debt. Nevertheless, the central bank has refrained from referring to it as a systemic risk. In contrast, card loans constitute only a very small part of the banking system’s overall book.

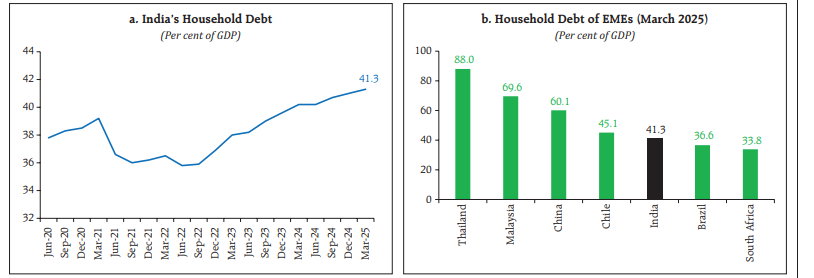

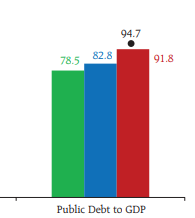

At the same time, personal loans, car loans, and consumer loans have more than doubled in the past seven years. Over 28 crore people are currently paying off loans, up from about 12.8 crore in 2018. The average debt per person has also grown from just Rs 3.4 lakh in 2018 to Rs 4.8 lakh in FY25. This debt is often used for many purchases, but it’s striking how much people are spending on smartphones like iPhones. Public Debt to GDP now stands at 94.7 with 41.3 percent of GDP now held by India’s household which reflects a worrying trend.

Reports hint that 60 percent of the borrowers default/struggle to pay their debt, which means 6 out of every 10 individuals live in a world where financing debt is super difficult. Almost 60 percent of EMIs are equal to or exceed the monthly family income, while 40 percent take on new loans to manage their existing payments, which is concerning

Why EMIs Are Everywhere in India

The term “EMI” stands for Equated Monthly Installment. It allows you to buy something expensive by paying a little each month, usually over 6 to 24 months. When you buy something on EMI, you don’t need to pay the full cost upfront, instead you pay monthly bills instead.

EMIs have become popular because of easy digital apps, credit cards, and buy-now-pay-later options that let you purchase expensive items with “no-cost EMI” or small monthly payments. People use EMIs to buy significant items like cars and homes, but now even phones, which seem like everyday items, are frequently bought on credit.

One of the most discussed trends is how many iPhones are bought in India through EMIs. Multiple reports suggest that nearly 70% of iPhones in India are purchased using EMIs, while 80 percent of cars are bought through loans.

In simple terms, this means that for every ten iPhones sold in India, about seven are paid for in monthly installments rather than all at once. This is particularly true for younger buyers, including those in their 20s and 30s, who may not have enough saved but still want the latest device.

This trend shows how easy it has become to borrow money for lifestyle purchases. When EMI options are available right at the checkout screen or through bank apps, it’s easy to click and buy. However, this convenience raises important questions about whether people are borrowing wisely or simply because they can.

Is EMI Buying Smart or Risky?

Buying an iPhone on EMI can be exciting. You get the phone right away and only pay small amounts each month. But there are also issues that many people don’t notice at first.

For example, many buyers end up paying EMIs that take 20–25% of their monthly income, especially young professionals earning modest salaries. This means that before they even pay rent, groceries, education fees, or save any money, a large portion of their earnings goes toward phone bills.

Some individuals continue paying for a phone even after its value drops. iPhones can lose nearly half their resale value within a year and even more after two years. So, if someone buys a phone on a two-year plan, they might still be paying for a phone worth much less two years later.

This kind of borrowing may offer quick access to a cool gadget. However, in the long run, it doesn’t help build savings. Instead, it adds to financial stress because people borrow money for items that don’t help them earn or build wealth.

The Bigger Picture

The easy availability of credit has helped many people fulfill their dreams, but it has also changed how people spend. Many Indians now rely on credit cards and EMIs not just for phones, but also for everyday expenses like groceries, fuel, education fees, and unexpected bills.

As credit cards and loans become more common, money that could be saved for emergencies or long-term goals often goes toward monthly bills for expensive things that don’t increase in value. This trend is part of why India’s overall household credit has risen sharply in the past decade, reaching its highest levels ever.

Central Banks’ role

According to reports, the Reserve Bank of India is looking into a small change in how lenders can manage loans for items like phones. It indicates that the RBI might soon let lenders, such as banks and non-bank lenders, remotely lock smartphones bought on credit if someone stops paying their EMIs.

This idea may sound extreme, but it could make lending safer for banks and other lenders, especially for small loans under Rs 1 lakh that are easier to default on. If lenders believe they can use technology to recover money more reliably, they might offer credit more responsibly and with clearer rules. This small change, allowing lenders to secure their loans through digital tools, may seem technical, but it could significantly impact how credit is offered in India. It could:

- Encourage lenders to be more careful about who they give credit to.

- Ensure borrowers understand the costs before they buy something on EMI.

- Help reduce defaults when people miss payments, which can lead to better borrowing terms in the long run.

- Shift the focus from borrowing for things we want now to smarter borrowing for important long-term needs.

In other words, it might help India develop a culture where credit is used wisely and not just for things like iPhones, but for goals that improve lives and financial security.

There’s nothing wrong with wanting a nice phone or a stylish gadget. iPhones are symbols of status and technology, representing aspiration for many. India’s smartphone market continues to grow, with brands like Apple achieving record sales through both cash and financing options.

If the RBI’s small change encourages people to think more about how they borrow, it could alter how Indians buy not just iPhones on EMI but many other valued items.

What matters is how we manage money and how credit shapes our future. When credit is easy, people borrow more. That’s why credit card debt and household loans are rising. However, when borrowing is handled responsibly, i.e., when people truly understand what they are paying for and its costs, credit can become a beneficial tool and not a trap.

Credit is powerful, as it can help make dreams a reality. But if used poorly, it can become a burden. The small changes currently being discussed in India might mark the start of a shift toward smarter, more informed borrowing that helps people buy wisely and build a more secure future.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post iPhones on EMI: Can Banks and NBFCs Lock Your Phone If You Default on Payments? appeared first on Trade Brains.

What's Your Reaction?