Nikhil Kamath Portfolio: How Did Nazara Tech and 2 Other Stocks Perform in Q3?

Synopsis: Nikhil Kamath’s Q3 portfolio comprises three key listed holdings, Nazara Technologies Ltd, Ather Energy Ltd, and Bluestone Jewellery & Lifestyle Ltd, held through Kamath Associates and Nksquared as of December 2025, reflecting a diversified investment spread across gaming, electric mobility, and lifestyle segments. Nikhil Kamath is an Indian entrepreneur and co-founder of Zerodha, India’s […] The post Nikhil Kamath Portfolio: How Did Nazara Tech and 2 Other Stocks Perform in Q3? appeared first on Trade Brains.

Synopsis: Nikhil Kamath’s Q3 portfolio comprises three key listed holdings, Nazara Technologies Ltd, Ather Energy Ltd, and Bluestone Jewellery & Lifestyle Ltd, held through Kamath Associates and Nksquared as of December 2025, reflecting a diversified investment spread across gaming, electric mobility, and lifestyle segments.

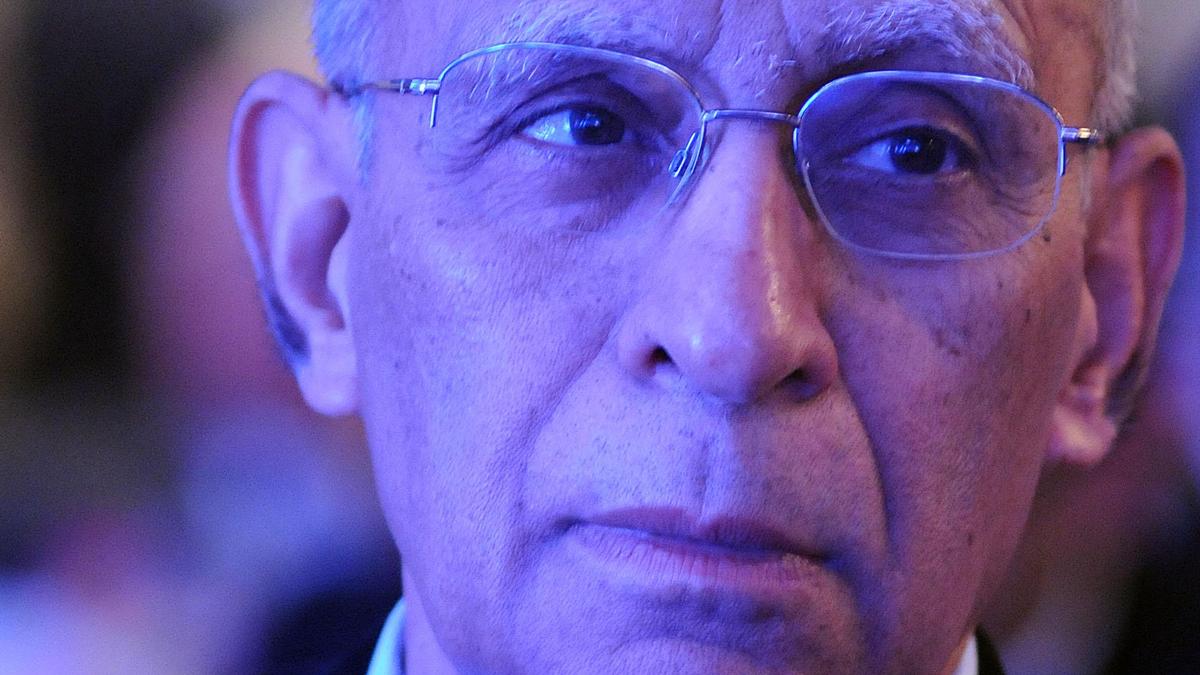

Nikhil Kamath is an Indian entrepreneur and co-founder of Zerodha, India’s leading stock trading platform, along with his brother Nithin Kamath. They are renowned for revolutionising trading in India with low-cost, technology-driven solutions and have also invested in several startups and unicorns.

As per corporate shareholdings filed for December 31, 2025, people matching Kamath Associates publicly hold 3 stocks with a net worth of over Rs 742.7 Crores. Let’s take a closer look at how the three listed stocks held by them have performed in Q3. During this period, some of his major investments showed good growth, gaining value and giving positive returns. Overall, his portfolio reflects a balanced approach, where he focuses on picking stocks with strong potential while managing risks carefully.

Nazara Technologies Ltd

Nazara Technologies, India’s sole publicly traded gaming company, is a multifaceted gaming and sports media platform that operates in India, Africa, North America, and other global markets.

Its portfolio includes Curve Games, Kiddopia, Animal Jam, Fusebox Games, World Cricket Championship, Sportskeeda, Funky Monkeys, and Smaash Entertainment. The company aims to create a global gaming platform with strong intellectual property, publishing, and operational capabilities.

Well-known personalities and co-founders of the leading discount brokerage app Zerodha, Nikhil Kamath and Nithin Kamath, hold approximately 1.62% stake in the company through their investment body, Kamath Associates, while their other investment entity, Nksquared, holds around 1.89% as of December 2025.

Q3 Performance

Its Revenue from operations declined by 24 percent YoY from Rs. 534.69 Crores in Q3FY25 to Rs. 405.97 Crores in Q3FY26, and it declined by 23 percent QoQ from Rs. 526.46 Crores in Q2FY26 to Rs. 405.97 Crores in Q3FY26.

Its Net Profit YoY declined by 35.3 percent from Rs. 13.68 Crores in Q3FY25 to Rs. 8.84 Crores in Q3FY26, and on a QoQ basis, from a loss of Rs. 33.93 Crores in Q2FY26, it turned to a profit of Rs. 8.84 Crores in Q3FY26.

Ather Energy Ltd

Ather Energy Ltd is an Indian electric two-wheeler manufacturer headquartered in Bengaluru, founded in 2013. The company focuses on designing, developing, and assembling electric scooters, battery packs, charging infrastructure, and supporting software systems in-house.

It operates on a vertically integrated and software-defined business model, making it a pioneer in the Indian electric two-wheeler (E2W) market. Ather manufactures popular electric scooter models, including the Ather 450 series and Ather Rizta.

Well-known personalities and co-founders of the leading discount brokerage app Zerodha, Nikhil Kamath and Nithin Kamath, hold approximately 1.80% stake in the company through their investment body, Kamath Associates, while their other investment entity, Nksquared, holds around 1.80% as of December 2025.

Q3 Performance

Its Revenue from operations rose by 50.2 percent YoY from Rs. 635 Crores in Q3FY25 to Rs. 954 Crores in Q3FY26, and it rose by 6.1 percent QoQ from Rs. 899 Crores in Q2FY26 to Rs. 954 Crores in Q3FY26.

Its Net loss YoY from Rs. 198 Crores in Q3FY25 reduced to a loss of Rs. 85 Crores in Q3FY26, and on a QoQ basis, from a loss of Rs. 154 Crores in Q2FY26, it reduced to a loss of Rs. 85 Crores in Q3FY26.

Ather Energy captured an 18.8% market share in Q3 FY26, recording an impressive 50% year-on-year growth. The company’s sales increased significantly from 45,252 units in FY25 to 67,851 units in FY26, reflecting strong demand and expanding market presence in the electric two-wheeler segment.

Bluestone Jewellery & Lifestyle Ltd

BlueStone Jewellery & Lifestyle Ltd, founded in 2011 by Gaurav Singh Kushwaha, is a digital-first, direct-to-consumer (DTC) brand specializing in contemporary fine jewelry, including diamond, gold, and platinum pieces.

It operates an omnichannel model, integrating its e-commerce platform with a network of many retail stores across India. The company focuses on modern design and craftsmanship, catering to a wide customer base with a diverse product range and offering features.

Nikhil Kamath and Nithin Kamath hold approximately 1.10% stake in the company through their investment body, Kamath Associates, while their other investment entity, Nksquared, holds around 1.10% as of December 2025.

Q3 Performance

Its Revenue from operations rose by 27.4 percent YoY from Rs. 587 Crores in Q3FY25 to Rs. 748 Crores in Q3FY26, and it rose by 45.8 percent QoQ from Rs. 513 Crores in Q2FY26 to Rs. 748 Crores in Q3FY26.

From a net-loss of Rs. 27 Crores in Q3FY25, it turned to a profit of Rs. 71 Crores in Q3FY26, and on a QoQ basis, from a loss of Rs. 49 Crores in Q2FY26 it turned to a profit of Rs. 71 Crores in Q3FY26.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post Nikhil Kamath Portfolio: How Did Nazara Tech and 2 Other Stocks Perform in Q3? appeared first on Trade Brains.

What's Your Reaction?