Data Centres, EVs and Renewable Energy: Are These Sectors Replacing Copper With Aluminium?

Synopsis: Rising copper prices, supply constraints, and growing demand from EVs, renewable energy, and AI data centres are driving industries to explore aluminium as an alternative. Abundant, lightweight, and recyclable, aluminium is gaining ground in power, automotive, and infrastructure applications. While copper remains essential for high-performance needs, aluminium is emerging as a cost-effective, long-term substitute. […] The post Data Centres, EVs and Renewable Energy: Are These Sectors Replacing Copper With Aluminium? appeared first on Trade Brains.

Synopsis: Rising copper prices, supply constraints, and growing demand from EVs, renewable energy, and AI data centres are driving industries to explore aluminium as an alternative. Abundant, lightweight, and recyclable, aluminium is gaining ground in power, automotive, and infrastructure applications. While copper remains essential for high-performance needs, aluminium is emerging as a cost-effective, long-term substitute.

Commodities markets are buzzing as copper prices hit record highs, driven by rising demand from electric vehicles, renewable energy, and AI-powered data centres. At the same time, aluminium, a lighter and more abundant metal, is quietly gaining attention across industries. Could aluminium emerge as the next go-to metal for industrial and energy applications?

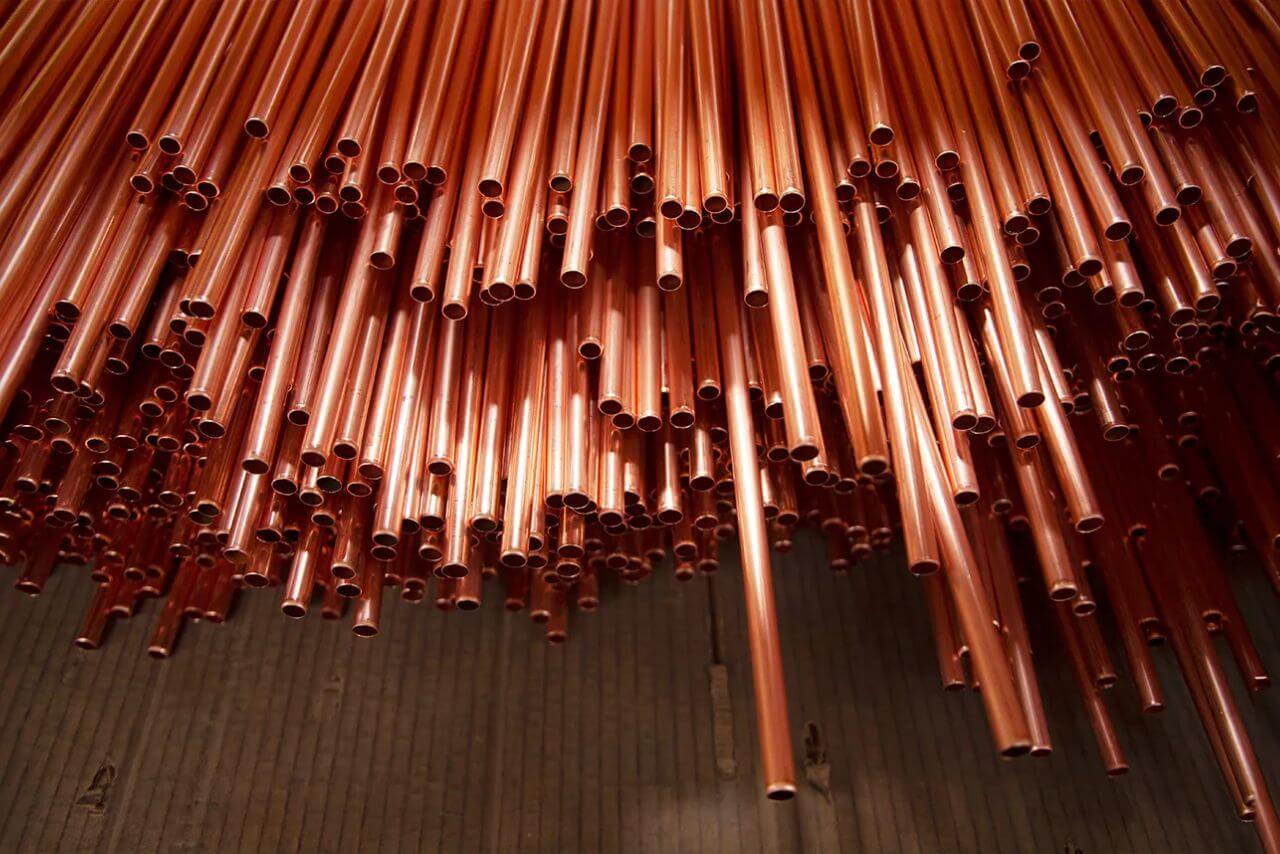

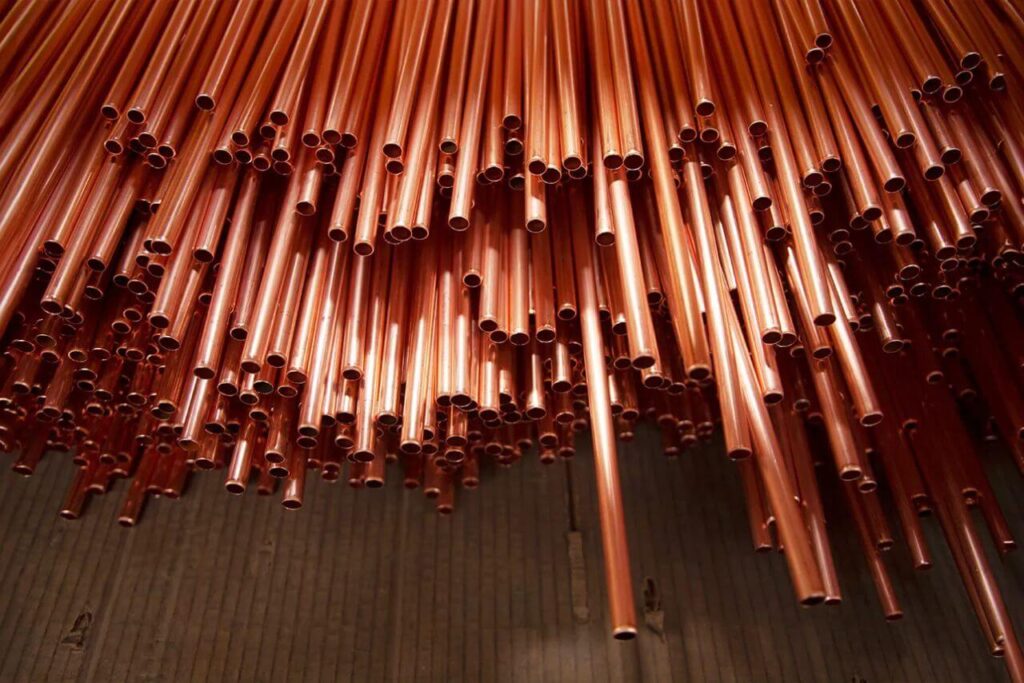

Why Copper Became So Important

Copper prices have seen a strong rise over the past year, according to a recent report by Fidelity. In early 2025, the metal was trading below USD 9,000 per tonne. Since then, prices have moved up steadily, reaching a record level of more than USD 13,000 per tonne by January 2026. This sharp increase has been driven by a combination of limited supply, higher investor interest, and policy-driven demand.

As with most commodities, copper prices depend on how supply and demand balance out. At present, demand is growing quickly, while supply remains tight, creating favourable conditions for higher prices. Copper is a key input for several long-term growth industries such as electric vehicles, renewable energy projects like wind and solar, and large data centres that support the expansion of artificial intelligence.

By 2030, demand from AI and data centres alone is expected to reach nearly 500,000 tonnes a year, a significant jump from previous levels. This comes on top of already strong usage from infrastructure spending, especially in rapidly developing countries such as China and India. Copper continues to be critical for housing, commercial buildings, power grids, and transportation networks. Research from Goldman Sachs points to three main factors behind the recent rally. First, copper buyers sharply increased their requests in December to withdraw metal from LME warehouses, highlighting supply tightness in markets outside the US. Second, expectations of strong AI-related demand, particularly from data centre construction, have supported prices, as these facilities require large amounts of copper for power and cooling systems.

There was also a broader market view that US economic policy was aimed at supporting stronger growth, which helped lift copper along with other risk assets at the start of the year. While Goldman Sachs expects consumption of semi-finished copper products in the US to rise, analysts believe this will have only a limited impact on global demand, as the US represents just about 7 percent of the overall market.

The Copper Problem: Cost, Scarcity, and Geopolitics

On the supply side, the copper market faces a challenging outlook. Analysts expect an annual shortfall of several million tonnes over the next 15 years. Production has already been disrupted by labour strikes in Chile and operational issues in countries like Indonesia. As demand continues to rise, miners are increasingly mining lower-grade ore, which lowers efficiency, pushes up costs, and adds environmental pressure. Developing new mines is a slow process, often taking around 18 years from discovery to full-scale production. This means supply is unlikely to catch up quickly, leaving a long-term gap between demand and available copper.

Despite strong demand, global supply faces major structural constraints. Reports indicate that half of the copper needed by 2035 still lacks funding or development plans. Falling ore grades, aging mines, and difficult environmental and social conditions in new mining areas are raising project costs and causing delays. Even with increased recycling, secondary copper is expected to cover about 50 percent of demand by 2050, the world will still need roughly 10 million tonnes of new primary copper each year over the next decade. Greenfield projects frequently face delays, and BHP notes that the 30 largest undeveloped copper projects have been postponed since 2014.

Copper prices on the London Metals Exchange (LME) surged 22 percent, rising from below USD 11,000 per tonne at the end of November to a record USD 13,387 on January 6. Goldman Sachs Research expects prices to stay around USD 13,000 in the first quarter of the year. A key factor likely to influence prices is a mid-year decision from the US government on refined copper tariffs. Buyers have been stockpiling copper in anticipation of an import tax, creating expectations of temporary shortages outside the US, according to Goldman Sachs analyst Eoin Dinsmore.

Aluminium: The Underrated Industrial Metal

Aluminium plays an important role across several fast-growing industries. Along with copper, lithium, and steel, it is considered one of the four key metals needed for the shift to new energy sources, according to BloombergNEF. Producing aluminium, however, requires a lot of electricity, and energy itself is becoming more constrained. For most of the past two decades, aluminium has been in surplus, as China, the world’s largest producer and consumer, expanded capacity using inexpensive coal-fired power. This helped keep prices relatively low even as demand grew.

Unlike copper, aluminium’s global resource base is abundant and widely distributed. The metal comes from bauxite, with global resources estimated at around 28 billion tonnes, enough to support extraction for many decades at current rates. Major reserves exist in countries such as Guinea, Australia, Brazil, and Vietnam, which reduces the risk of supply disruptions that often affect copper. By comparison, economically viable copper reserves are much more limited. The scale and distribution of aluminium resources give it a strategic advantage as a reliable structural metal for industries worldwide.

Aluminium is also valued for its physical properties, making it ideal for applications where lightweight construction and recyclability are important. Producing aluminium from recycled scrap requires only about 5 percent of the energy needed to make it from bauxite, significantly cutting both costs and carbon emissions. This energy efficiency is boosting aluminium’s appeal in sectors like automotive, aerospace, and packaging, where sustainability and low environmental impact are increasingly influencing material choices.

Aluminium vs Copper

Copper and aluminium are both widely used as electrical conductors because of their high conductivity and low resistance. While they share some qualities, such as flexibility and resistance to corrosion, each metal has traits that make it better suited for specific applications, according to a report from Dynamic Cables Limited.

Aluminium is lightweight, making it easier to install and suitable for applications where weight matters. It has good electrical and thermal conductivity and can handle high temperatures without melting or burning. Aluminium is fully recyclable, keeping all its original properties during recycling, and is cheaper than copper. It also offers reasonable corrosion resistance, though slightly less than copper.

Copper, on the other hand, has superior conductivity, second only to silver, along with excellent heat and corrosion resistance. Its high melting point and thermal stability make it ideal for electrical and heat-intensive applications. Copper wiring is versatile, compatible with other metals, and comes in different forms, such as bare or stranded wire, making it suitable for a wide range of uses.

When comparing the two, copper conductors are more energy-efficient, carrying more current with less energy loss, while aluminium is generally less expensive, making it a more cost-effective choice for budget-sensitive projects. Copper is also more durable and safer, being less prone to corrosion and electrical hazards. Both metals are recyclable and have a low environmental footprint, though copper’s higher recycling rate gives it an advantage.

Copper has long been preferred for electrical applications because of its high conductivity and low resistance. However, its high cost has increased the use of aluminium, which still conducts electricity well but at a lower price. Aluminium’s lower strength means more material is needed to carry the same current, and it forms an oxide layer when exposed to air, which can affect connections over time. Despite these drawbacks, aluminium remains practical for cost-conscious projects, while copper continues to be the choice where reliability and performance are priorities.

Aluminium Is Already Replacing Copper

Aluminium is increasingly being used as a substitute for copper across several industries, mainly due to rising costs and supply challenges. With copper prices remaining high and unpredictable, manufacturers are turning to aluminium for applications like power cables, automotive wiring, and transmission lines. Although aluminium has lower conductivity than copper, its lighter weight and advances in alloy technology often make up for this, making it a cost-effective option for large projects.

The move toward aluminium is also supported by shifts in design approaches and a focus on sustainability. Aluminium is easier to recycle, widely available, and better suited for weight-sensitive uses such as electric vehicles and renewable energy infrastructure. As engineering standards evolve and systems are increasingly designed around aluminium instead of copper, its adoption is no longer just about cutting costs. It is emerging as a long-term trend that is reshaping demand patterns in the global metals market.

Conclusion

Aluminium is steadily gaining ground as a practical alternative to copper, driven by rising copper prices, supply constraints, and the growing focus on sustainability. Its abundance, recyclability, and lighter weight make it well-suited for applications in sectors like electric vehicles, renewable energy, and power transmission. While copper remains unmatched in conductivity and durability, aluminium’s evolving alloy technology and cost advantages make it a strong contender for many industrial uses.

The shift from copper to aluminium is not just a temporary trend but reflects a broader structural change in the global metals market. As industries adapt their designs and production methods to take advantage of aluminium’s benefits, its role is likely to expand further. However, copper will continue to be critical for applications where performance, reliability, and efficiency are non-negotiable, meaning both metals will coexist, each serving distinct but complementary roles in the future of industrial and energy infrastructure.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post Data Centres, EVs and Renewable Energy: Are These Sectors Replacing Copper With Aluminium? appeared first on Trade Brains.

What's Your Reaction?